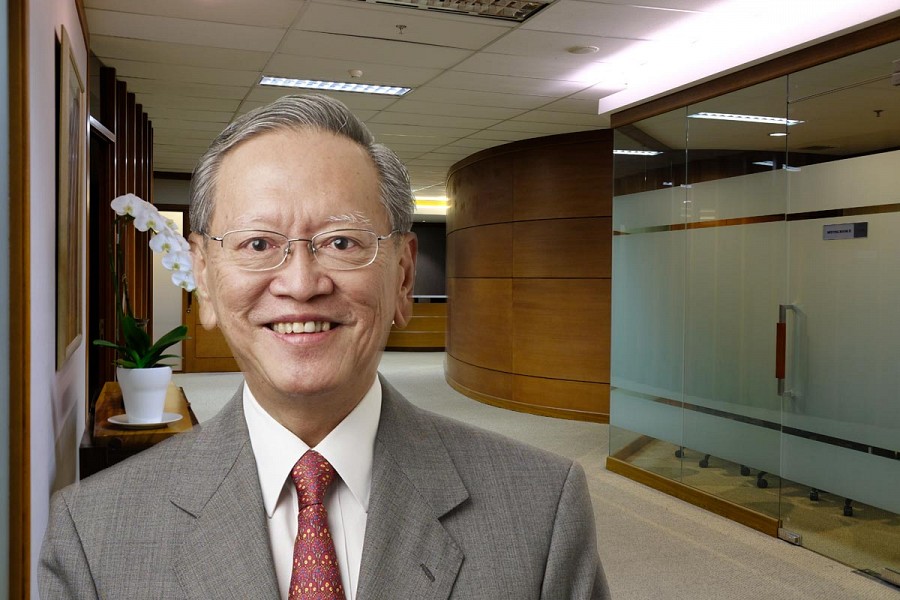

Our Firm

Every transaction, whether involving a new venture, changes to an existing business structure, or a review of contractual arrangements, has direct or indirect tax consequences.Team

Harsono Strategic Consulting (HSC) is an independent firm providing business and related tax and customs advisory services to multinational corporations, joint ventures and domestic companies in a wide range of business sectors.Expertise

HSC is well equipped to assist clients with their taxation affairs and related business issues.

Tax Consulting

We can help by providing advice on the tax implications of a contemplated structure or agreement, evaluating risks, and formulating a strategy to minimize tax costs.

Read More

Tax Dispute Resolution

We can help with a tax audit and the objection, appeal and judicial review process, and formulate a strategy for handling the case in the most effective manner.

Read More

Transfer Pricing

We can prepare transfer pricing documentation and carry out a comprehensive risk assessment review to identify and quantify the risk of transfer pricing adjustment in advance of Indonesian tax authority scrutiny.

Read More

Customs and Excise

We can help obtain exemptions and other facilities, customs clearance, and assist with customs audits and disputes.

Read More

Business Advisory Services

We can structure tax efficient deals and conduct due diligence reviews.

Read More

Publications

Our newsletters keep our clients apprised of important changes to Indonesia's tax, customs, and investment regulations.News

Recent news from Indonesia is provided to keep you informed and up-to-date.BSI proyeksikan penjualan emas pada April 2025 capai 230 kilogram

PT Bank Syariah Indonesia Tbk (BSI) memproyeksikan penjualan emas pada akhir bulan April 2025 melonjak menjadi 230 ...

PT Bank Syariah Indonesia Tbk (BSI) memproyeksikan penjualan emas pada akhir bulan April 2025 melonjak menjadi 230 ...

Aplikasi Pintu diunduh lebih dari 9 juta kali

Aplikasi crypto all-in-one, Pintu, sebagai Pedagang Aset Keuangan Digital (PAKD) yang terdaftar resmi di Otoritas Jasa ...

Aplikasi crypto all-in-one, Pintu, sebagai Pedagang Aset Keuangan Digital (PAKD) yang terdaftar resmi di Otoritas Jasa ...

Ekonom Unand ingatkan pentingnya disiplin fiskal jaga kurs rupiah

Pengamat ekonomi dari Universitas Andalas (Unand) Endrizal Ridwan menyampaikan sejumlah solusi bisa dilakukan ...

Pengamat ekonomi dari Universitas Andalas (Unand) Endrizal Ridwan menyampaikan sejumlah solusi bisa dilakukan ...

Menkeu pastikan gaji dosen dan beasiswa tetap jadi prioritas

Menteri Keuangan Sri Mulyani Indrawati memastikan gaji dosen serta beasiswa untuk pelajar dan mahasiswa tetap menjadi ...

Menteri Keuangan Sri Mulyani Indrawati memastikan gaji dosen serta beasiswa untuk pelajar dan mahasiswa tetap menjadi ...

Sri Mulyani jelaskan alasan tak semua dosen menerima tukin

Menteri Keuangan Sri Mulyani menjelaskan alasan mengapa tak semua dosen berstatus Aparatur Sipil Negara (ASN) menerima ...

Menteri Keuangan Sri Mulyani menjelaskan alasan mengapa tak semua dosen berstatus Aparatur Sipil Negara (ASN) menerima ...

BSI jelaskan keuntungan cicil emas sebagai solusi investasi saat ini

Direktur Sales & Distribution BSI Anton Sukarna menjelaskan keuntungan skema cicil emas sebagai solusi investasi ...

Direktur Sales & Distribution BSI Anton Sukarna menjelaskan keuntungan skema cicil emas sebagai solusi investasi ...